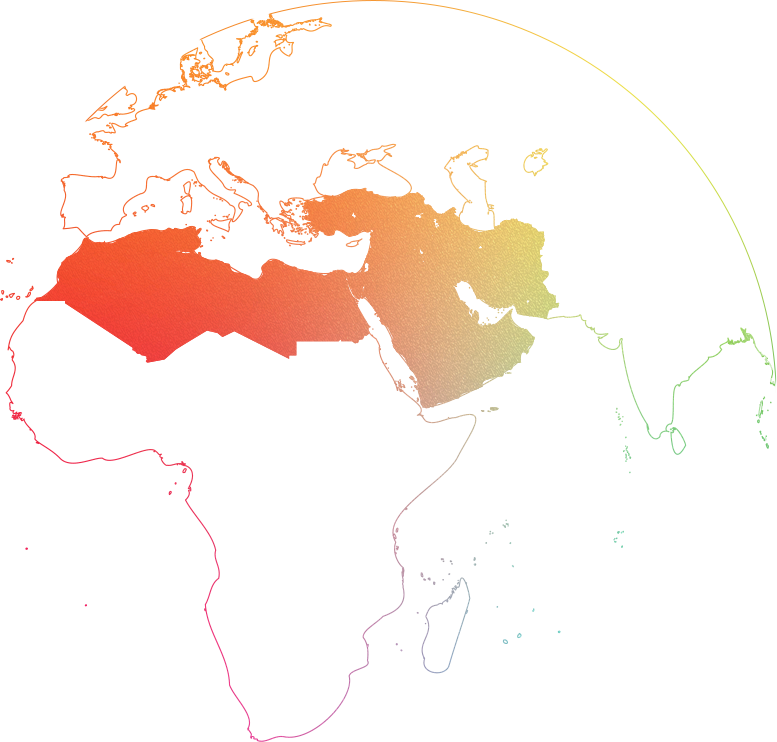

Middle East, North Africa and Turkey (MENAT)

$35 billion (Turkey 17%)

7%

Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, Turkey, United Arab Emirates and Yemen

Region in short:

- 17 individual countries with very heterogeneous healthcare systems.

- Mix of low-, middle-, and high-income countries, almost all of which offer a socialized healthcare system.

- Proportion of public spending compared to out-of-pocket spending can vary widely.

Rare diseases segment:

- A growing segment in the MENAT region, driven by genetic rare diseases, which are many times higher than in the West due to consanguinity.

- Funding for rare diseases and orphan medicines is generally stronger in the Gulf region, but North Africa, led by Algeria, and now Egypt with its SMA launch, form the next wave.

- Oncology is small comparatively to the regions' size due to its young population, but is still a very well-funded segment.

- Named Patient Programs, especially for rare and specialized products, exist primarily in the wealthier countries and are an attractive entry point on the path to full commercialization.

Middle East, North Africa and Turkey (MENAT)

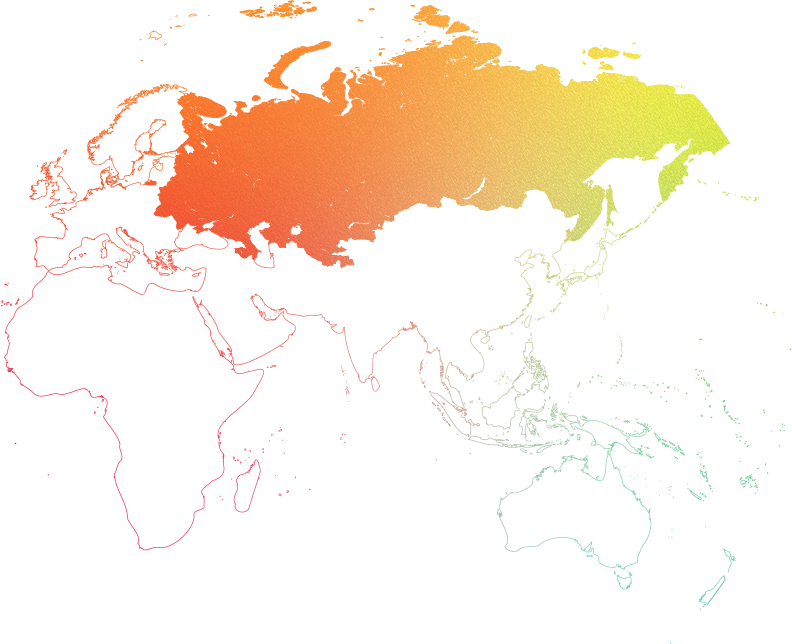

Russia and CIS

$22 billion

11-14%

Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine, Uzbekistan

Region in short:

- The region consists of formerly constituent republics of the Soviet Union and includes 11 countries, not all of which are necessarily part of the official CIS.

- Russia is the dominant market, worth over $16 billion in 2020. The remaining CIS markets, driven mainly by Kazakhstan, Belarus and Uzbekistan, are worth about $6 billion.

- Most of the former Soviet republics retain the socialized healthcare form (healthcare is free for all). However, what falls under universal healthcare can vary drastically by market.

Rare diseases segment:

- Rare diseases, orphan products and oncology are very well-funded in Russia and other leading markets of the CIS region.

- Russia accounts for around 90% of total product sales.

- With the launch of the Krug Dobra (Circle of Kindness) fund in Russia in 2021, rare disease funding is expected to exceed $2 billion in 2022.

- Oncology funding has doubled over the last three years.

- For rare and specialized products, there are Named Patient Programs, especially in Russia, which represent an attractive entry point on the path to full commercialisation, especially with the new Krug Dobra fund.

Russia and CIS

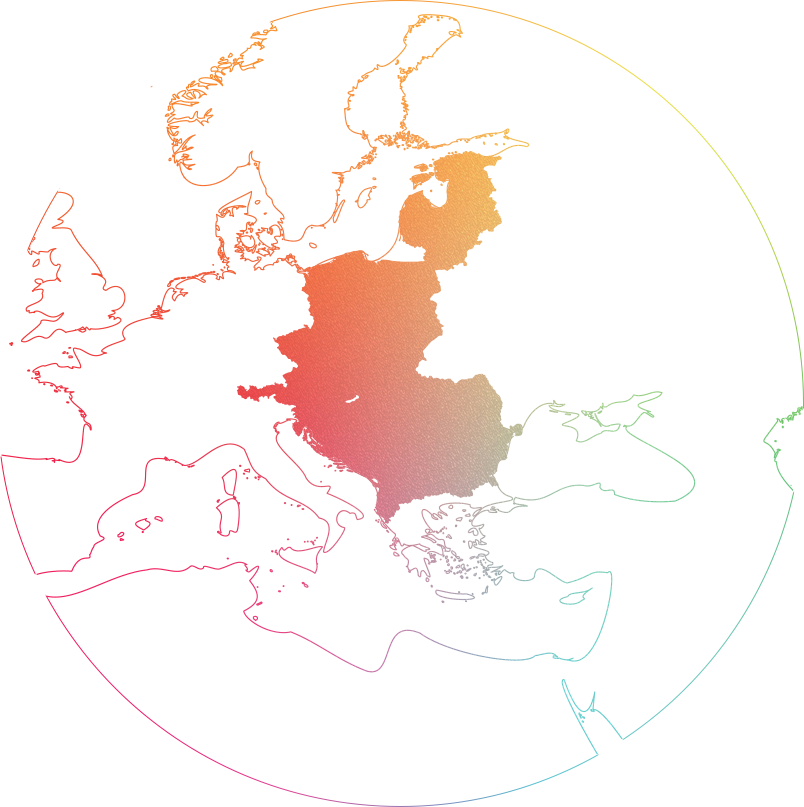

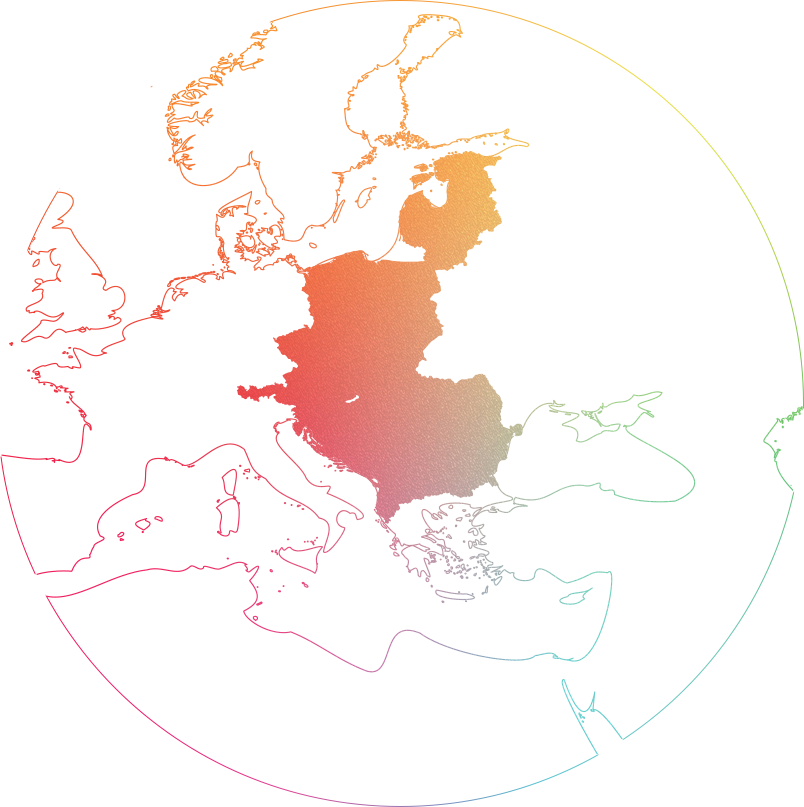

Central and Eastern Europe (CEE)

$21.8 billion

5-6%

Austria, Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Kosovo, Latvia, Lithuania, North Macedonia, Poland, Romania, Serbia, Slovakia, Slovenia, Montenegro

Region in short:

- The CEE region covers Central Europe, the Baltics, Eastern Europe, and South Eastern Europe.

- The focus is on nine countries: Bulgaria, Croatia, Czech Republic, Hungary, Lithuania, Poland, Romania, Slovakia, and Slovenia. These countries have some of the most developed healthcare systems in Europe.

- Poland was by far the leading pharmaceutical market in CEE in 2019, with sales of over €7.2 billion ($8 billion). Romania ranked second with pharmaceutical market sales of €3.1 billion ($3.5 billion) this year. In addition, the Czech Republic was around €3 billion ($3.3 billion).

Rare diseases segment:

- Reimbursement decisions are mostly made by the national health policy authorities.

- Access to reimbursed orphan drugs varies widely.

- The type of approval plays an important role in many CEE countries. In the Czech Republic, Lithuania and Slovakia, reimbursement status is significantly associated with the type of marketing authorization, whereas in Croatia, Estonia, Hungary and Lithuania, the type of disease is significantly associated with reimbursement status.

- The proportion of orphan drugs reimbursed is not significantly associated with GDP or GDP per capita.

- Croatia, Hungary, Lithuania, Romania and Slovakia have specific laws/policies for orphan drugs.

Central and Eastern Europe (CEE)

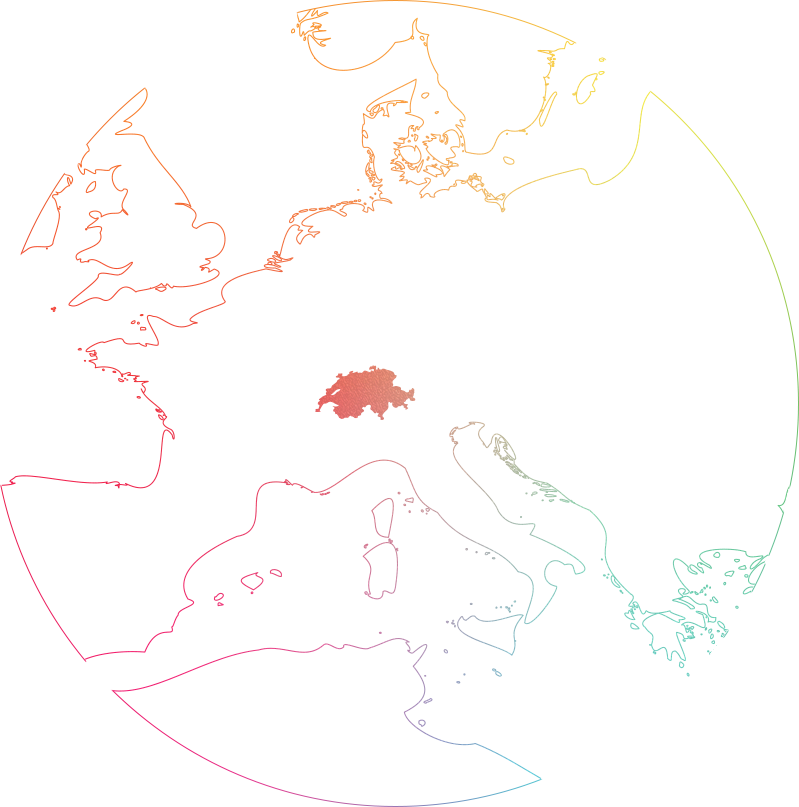

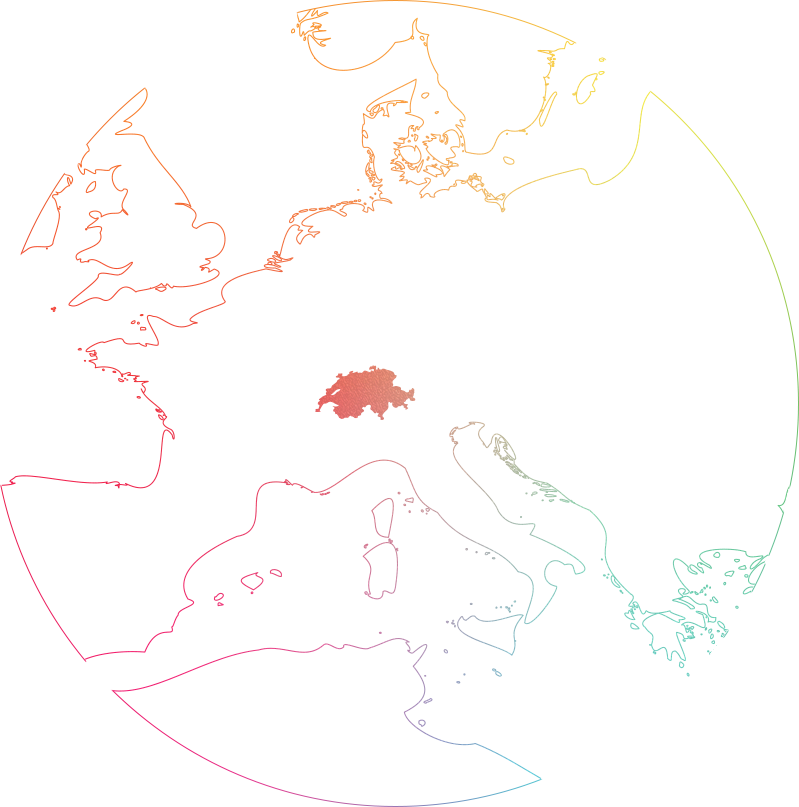

Switzerland

$6.6 billion

1-2%

Country in short:

- Switzerland is not a member of the EU and does not follow the EMA regulations. Drugs are registered through the national authority Swissmedic.

- Switzerland is one of the highest GDP per capita markets in the world.

- Healthcare system is hybrid and highly decentralized, with the cantons or federal states playing a key role. The system is financed by premiums paid by the insured, taxes (mostly cantonal), social insurance contributions and out-of-pocket payments.

- Residents are required to purchase insurance from private insurers.

Rare diseases segment:

- Due to its position outside the EU, Switzerland is often overlooked for rare and orphan products.

- While Switzerland has a Named Patient System, it is still attractive to pursue approval for rare and orphan products due to high level of reimbursement from Swiss insurers and the resulting better access.

Switzerland

Latin America (LATAM)

$50 billion

11-14%

Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Guyana, Guatemala, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, Suriname, Trinidad and Tobago, Uruguay, Venezuela

Region in short:

- A developing market, complicated and diverse in terms of regulatory, reimbursement, market, demographics and politics.

- Struggling to align its public spending.

Rare diseases segment:

- The region's health systems struggle to provide funds for complex, high-cost treatments.

- Brazil has pioneered in the development of specific regulations for rare diseases and gene therapies. However, these advances have had unintended consequences for the other institutions involved in the incorporation process, such as the increase in requests for inclusion of therapies in the public system.

- All Latin American countries have enshrined 'health for all' in their constitutions. This obliges private and public health services to procure prescribed treatment from abroad when it is not available locally.

Latin America (LATAM)

Greece, Cyprus, Malta

$4.6 billion

2%

Region in short:

- The Eastern Mediterranean markets of Cyprus, Greece and Malta are generally combined.

- All three markets are European Union countries, part of the EMA.

- Greece is by far the largest market by population and market size, accounting for over 90% of the potential.

Rare diseases segment:

- All three markets reimburse rare disease products.

- Greece, via the IFET, allows for procurement of unregistered and withdrawn products directly from manufacturers.

- Cyprus and Malta reimburse specialty therapies through main reimbursement systems.

Greece, Cyprus, Malta

Israel

$3.4 billion

3%

Israel, Palestinian National Authority

Region in short:

- The Israeli market is expected to grow steadily, with a high penetration rate of innovative medicines.

- Key drivers are a strong network of academic and research institutes, R&D facilities and developed medical facilities.

- Israel spends 7.5% of its GDP on the public healthcare system, providing universal healthcare coverage to its entire population via four HMOs and a network of hospitals, community clinics and specialized doctors.

- Israel’s healthcare policy makers have been focusing on promoting healthy nutrition and lifestyle, preventive medicine and age-based screening standards.

Rare diseases segment:

- Reimbursement is done once a year through a national health basket committee that evaluates all new pharmaceuticals and technologies submitted.

- Focus on scientific research and a community-based healthcare distribution system has made Israel an ideal candidate for many research projects in rare diseases.

- No orphan drug designation in registration or in reimbursement, but there have been attempts for some years to change the status.

- For many rare diseases there are patient associations which push for acknowledgment, access of treatments and reimbursement. Some are also supported by specific HCPs.

Israel

Australia, New Zealand and Southeast Asia (ANZSEA)

$12 billion (Australia), $1.3 billion (New Zealand), $12.5 billion (South East Asia)

2-5%

Australia, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, New Zealand, Papua New Guinea, Philippines, Singapore, Timor-Leste, Thailand, and Vietnam

Region in short:

Australia is a government-reimbursed market although achieving reimbursement is extremely challenging and costly

SEA and NZ are predominantly private markets with minimal Government subsidy

Core markets in SEA for high-cost medicines include Singapore, Malaysia, Brunei, Thailand and Vietnam

In SEA high-cost medicines are largely inaccessible due to socio-economic factors

Named Patient Access Programs are permitted across ST’s regions without any regulatory approvals, to enable early access to specialist therapies for life threatening conditions

Rare diseases segment:

In Australia, Orphan Drug Designation may be granted for therapies to treat life-threatening or debilitating conditions affecting fewer than five in 10,000 people. The key advantage of an orphan designation is that regulatory submission fees are waived, and some reimbursement submission fees are waived for the first application. Orphan designation does not provide any market exclusivity benefits

In New Zealand, there is provision for Government funding of medicines via Pharmac, however it is widely established that opportunities are limited. In addition, some NZ private health insurers fund some specialty medicines for eligible members

In Singapore and other SEA countries, high-cost medicines are out of reach for most patients unless they are privately insured. Insured patients may receive medicines on a subsidized basis via Government or private insurance schemes.

Australia, New Zealand and Southeast Asia (ANZSEA)

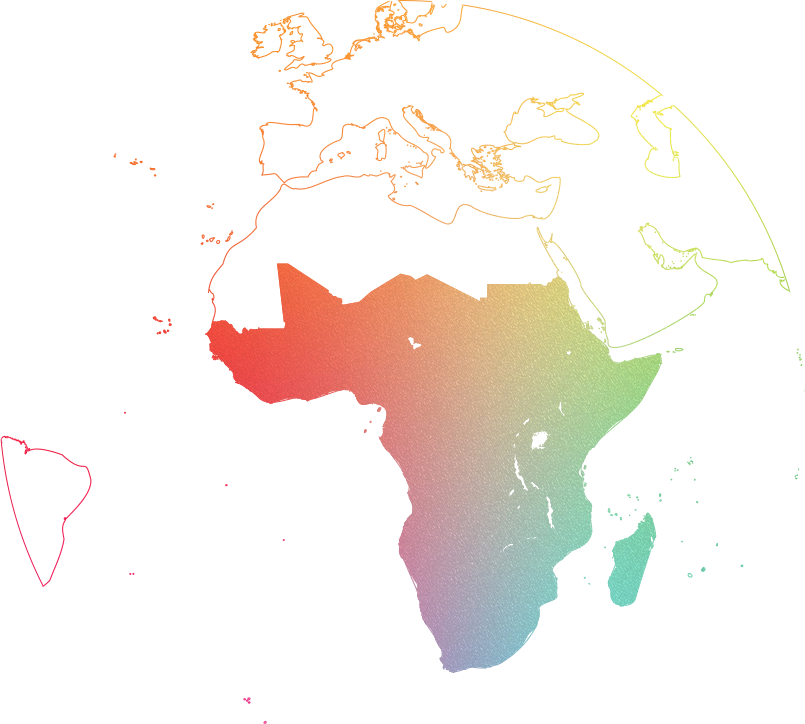

Subcontinental Africa

$25 billion

6%

Angola, Benin, Botswana, Burkina Faso, Burundi, Cabo Verde, Cameroon, Central African Republic, Chad, Comoros, Congo, Democratic Republic of Congo, Cote d'Ivoire, Djibouti, Equatorial Guinea, Eritrea, Eswatini, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritius, Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, South Sudan, Sudan, Tanzania, Togo, Uganda, Zambia, Zimbabwe

Region in short:

- The African subcontinent, outside of North Africa, is rapidly evolving from its infancy compared to the rest of the global pharmaceutical market.

- Healthcare systems are highly fragmented, with very little public procurement outside of a few wealthy nations.

- South Africa and Nigeria lead the region in terms of overall pharmaceutical market size, but healthcare spending on orphan medicines is very limited across the continent.

Rare disease segment:

- Named Patient Programs are available across the continent. However, funding remains a limiting factor for their widespread implementation.

- South Africa's Section 21 provides a good pathway for orphan drugs, but procurement is expected to come from a private insurer.

- OOP and NGOs are likely to be the financiers of orphan medicines for the foreseeable future, with economies gradually expanding to cover specialty medicines.

Subcontinental Africa

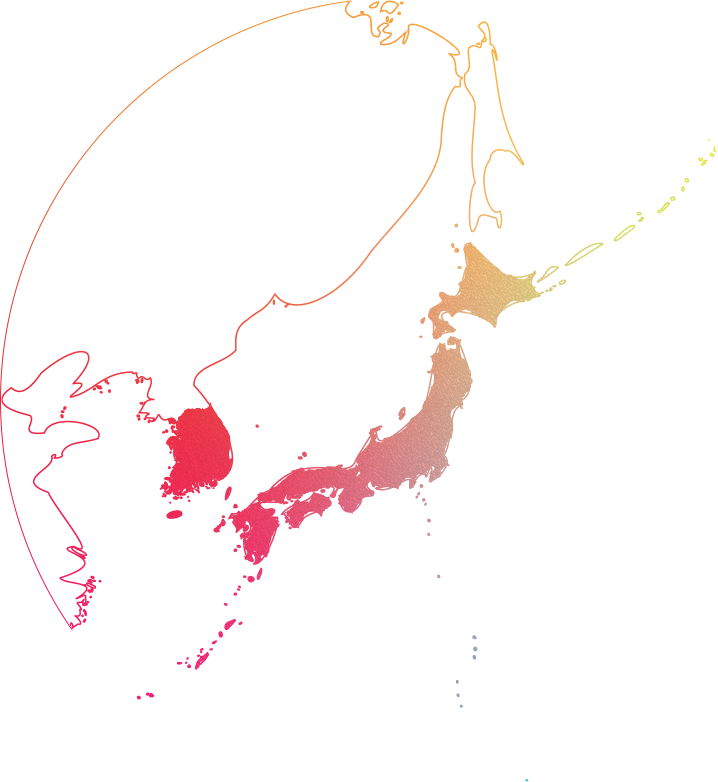

Japan and South Korea

$75 billion (Japan), $23 billion (South Korea)

1% (Japan), 2–3% (South Korea)

Region in short:

Both Japan and Korea have universal healthcare systems funded by social / national health insurance, government subsidies, and patient co-pays.

The role of private health insurance is limited in Japan, but has a larger role in South Korea where patient co-pays are higher.

Rare disease segment:

Orphan Drug Designation is available in both Japan and South Korea and enables accelerated regulator review and premium pricing.

Local ethno-bridging and pivotal trials are often still required in Japan, although there is increasing flexibility extended to orphan drugs. In contrast, South Korea will often wave local trial requirements for orphan drugs.

Pricing and reimbursement is relatively generous in both Japan and South Korea.

In Japan, almost all new drugs receive reimbursement, and drug prices trend towards the EU4+ UK average. Orphan drugs can sometimes command pricing close to US levels.

In South Korea, reimbursement rates are high for orphan drugs – although not all new drugs are reimbursed – and prices are generally set at the lowest of a basket of reference countries (US, EU4+UK, Japan, Switzerland).

Named Patient Access Programs are not in use in Japan, although are in South Korea in serious or urgent cases.

Japan and South Korea

Canada

$40 billion

6–11%

Region in short:

- The Canadian market is growing steadily, driven by an aging population, the rising prevalence of chronic diseases, and the adoption of innovative therapies.

- Underpinned by a robust regulatory, health technology assessment and pricing regulation framework.

- Canadian healthcare system is defined by public and private sector involvement, leading to broader access to treatments and support for innovation, but also resulting in delayed access to healthcare systems and innovative therapies.

- Healthcare is a provincial responsibility, operating within a universal, publicly funded system called Medicare.

Rare disease segment:

- Canada currently has a number of organizations to support advocacy, education,

research and access to medicines:- Canadian Rare Disease Network

- Quebec association for rare disease (www.rqmo.org and www.rare.quebec) - Governmental strategies: National Strategy for Drugs for Rare Diseases

- Health Canada’s Special Access Program (SAP) enables priority drug pathways and reviews.

- Patient advocacy plays a crucial role in shaping Canadian healthcare policies,

improving access to care, and ensuring the voices of patients and caregivers

are included in decision-making processes.

Canada

Greater China

$160.2 billion

7-8%

Mainland China, Hong Kong, Macau, Taiwan

Region in short:

Mainland China stands for one of the fastest growing giant markets for global pharmaceutical industry.

The healthcare system in Mainland China has been reforming since late 2010 towards the standard similar to the US/Europe, both in market access and regulatory landscape.

Hong Kong, Macau and Taiwan healthcare systems are more similar to the healthcare systems of developed countries and can act as a pilot area for new drugs in Greater China.

Rare diseases segment:

In the recent years, a policy for rare disease drug registration, reimbursement and market access in mainland China has been rapidly evolving.

Rare disease is defined by catalogue, and drugs for designated rare diseases will gain clinical trial waiver.

Free pricing before national reimbursement; in China national reimbursement negotiation, rare disease drugs are highly valued and easy to be included; global reference price will be referred to in price negotiation.

Greater China

Expertise

The aim of the alliance is to provide the best service and flexibility to our pharmaceutical partners with orphan portfolios in a broader territory.

Together we can achieve more.

With deep understanding of local healthcare systems, we can support our partners to expand their business throughout the complex WODA regions.

Contact us